Apparently, neither proponents nor opponents of supply management are able to present their figures in an unbiased rigorous fashion.

Consolidation of dairy farms has been faster in Australia than in Canada. Well, it depends on the period you want to consider. For instance, between 1970 and 2014, consolidation has been faster in Canada. Over this period, the number of Canadian dairy farms decreased by 78%, 71% in Australia. For the period 2008-2014, the rate slowed significantly in Australia to 16% (8% in Canada). Production wise, between 1970 and 2013, Australia experienced a 23% increase while production in Canada barely grew (+1%). Between 2008 and 2013, production grew by 3% in both countries. However, there is one common dynamic: the five to ten-year period following a significant policy change (introduction of supply management in 1970 in Canada, deregulation in 2000 in Australia) saw a rapid consolidation and a drop in production in both countries, which is to be expected as farms have to adapt to a new environment and delayed changes are accelerated. Besides, it is interesting to see that nobody talks about the extreme drought experienced by many Australia regions between 1995 and 2009 (especially between 1995 and 2003) and how it has affected dairy farms, most likely magnifying the effects of deregulation. Similarly, since the introduction of a price cap on quota in 2007, quota markets in Canada are feeble and the recent consolidation rate in Canada has been slowed somehow artificially.

I also find a bit misleading the comparison of milk retail price used by Dairy Farmers of Canada, especially in the case of France, a country I know very well. Unlike Canada, most of the consumption of fluid milk in France is made of UHT ½-skimmed milk (about 70% of fluid milk retail market). The average price per liter of UHT ½ skimmed milk in France was 1.15 CAD according to official statistics, not 1.81 (the price of fresh whole milk). I have not checked yet any such discrepancies for the other countries used in the comparison. Any relevant comparison of milk price must account for the differences between milk consumption patterns.

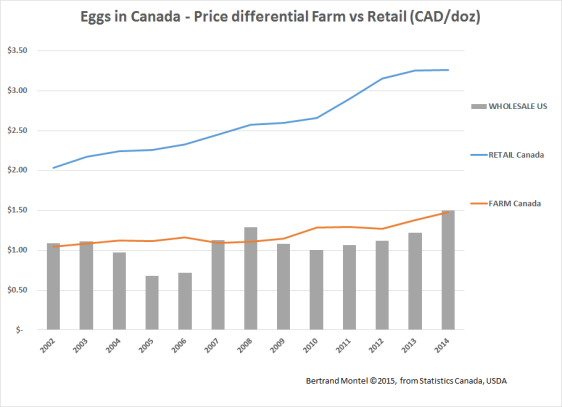

Talking about price, I took a look at egg prices in Canada, at the farm gate and on the retail shelf. It was very instructive. First, farm gate prices in Canada are in line with wholesale price in the US. This means that Canadian egg producers could be competitive on the North-American market, especially considering the strength of biosafety protocols in Canada. However, the most interesting thing is the differential between farm gate and retail prices which has been growing for a decade or so (see figure below).

Regarding economic contribution of the dairy industry, the proponents of supply management tend to forget to outline that about a third of contributed jobs and GDP, half of fiscal revenues come from the induced effect, which is the most tenuous one and is widely debated in economists’ circles as to its relevance. Besides, they do not highlight how Saputo and Agropur are the cornerstones of the industry nor do they show what would be lost in phasing out supply management (perhaps they want us to believe that all would be lost).

We could fight over these figures forever and forget what the real issues are.

The real issues for the dairy industry are that strengthening forces are weakening the three pillars of supply management: import control, production discipline and price fixing. I have discussed them in a previous post. Like any public policy, supply management has an expiry date, and my guess is that it is before 2030. By then, supply management could well be about 6,000 dairy farms, a handful of dairy processors, and a few retailers fighting over a dormant market, triggering at some point a major crisis originating in a spat between Ontario and Quebec. The dairy industry itself will ask for dismantling supply management, but it may well have lost any political goodwill – the fourth pillar of supply management – to fund the transition by that time.

Some people should really think honestly about the two following questions: how long can we expect to make supply management work in the interest of most of its stakeholders? Are we sure we can get enough political support for massive assistance funding when time comes? Right now, there is an apparent consensus on the fact that phasing out supply management requires financial assistance for dairy farmers and processors. The industry should take advantage of that to develop a vision and a strategy, and start investing in its future.